NZD/JPY Price Analysis: Pair rises within channel, bearish crossover may signal decline

- NZD/JPY price up in Tuesday's session, mildly rose to 91.65.

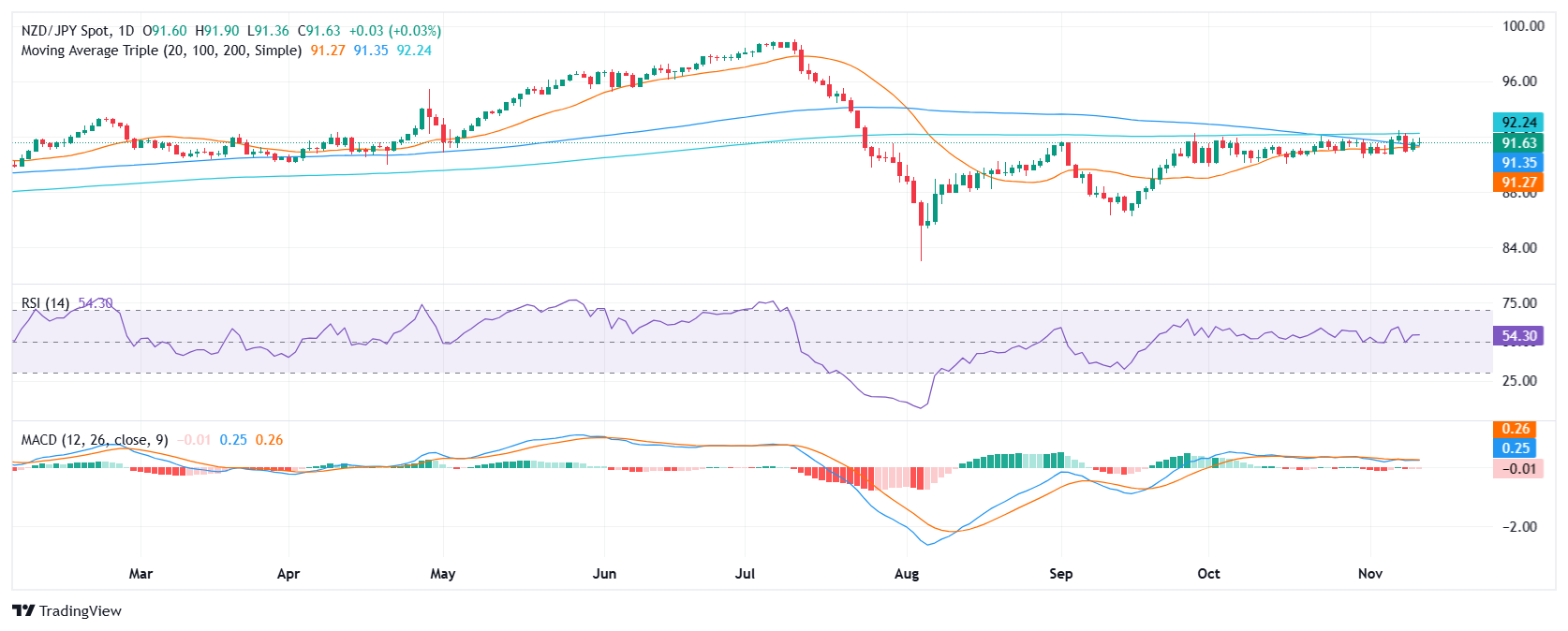

- The pair rose some but stayed in a trading channel from 92.00 and 91.00.

- RSI displayed growing buying pressure, while MACD showed flat selling pressure during the past price action.

The NZD/JPY rose mildly to 91.65 in Tuesday's session. The pair saw some gains but remains stuck in a clear trading channel between 92.00 and 91.00. A bearish crossover, about to be completed between the 20 and 100-day Simple Moving Average (SMA) might push the pair lower.

Despite rising Relative Strength Index (RSI) buying pressure and flat Moving Average Convergence Divergence (MACD) selling pressure, overall momentum seems to be mixed. The pair’s latest price action formed a neutral candlestick pattern, following negative and positive candles, suggesting indecisiveness in trend.This suggests that the overall market sentiment is neutral, with neither buyers nor sellers holding a clear advantage. However, the potential bearish crossover between the 20 and 100-day SMAs could signal a potential decline in the pair's value.

Traders should monitor the boundaries of the mentioned channel to gauge the pair's future direction as well as the pending bearish crossover for potential losses.

NZD/JPY daily chart