NZD/USD Price Analysis: Bulls testing bearish commitments at key levels, ripening for a fading opportunity

- NZD/USD bulls are in the market but a fading opportunity could be on the cards.

- Friday is the end of the three-day cycle that could prove fruitful for the bears.

The New Zealand dollar strengthened for the second straight session as the US dollar continues to slide. An eight-week high was made on fresh selling of the Greenback as further data pointed to disinflation in the US economy signaling the Federal Reserve will need to adopt a less hawkish stance this year. meanwhile, although New Zealand's inflation rate slowed to 6.7% in the first quarter, it is still above the Reserve Bank of New Zealand's target range of 1-3% over the medium term.

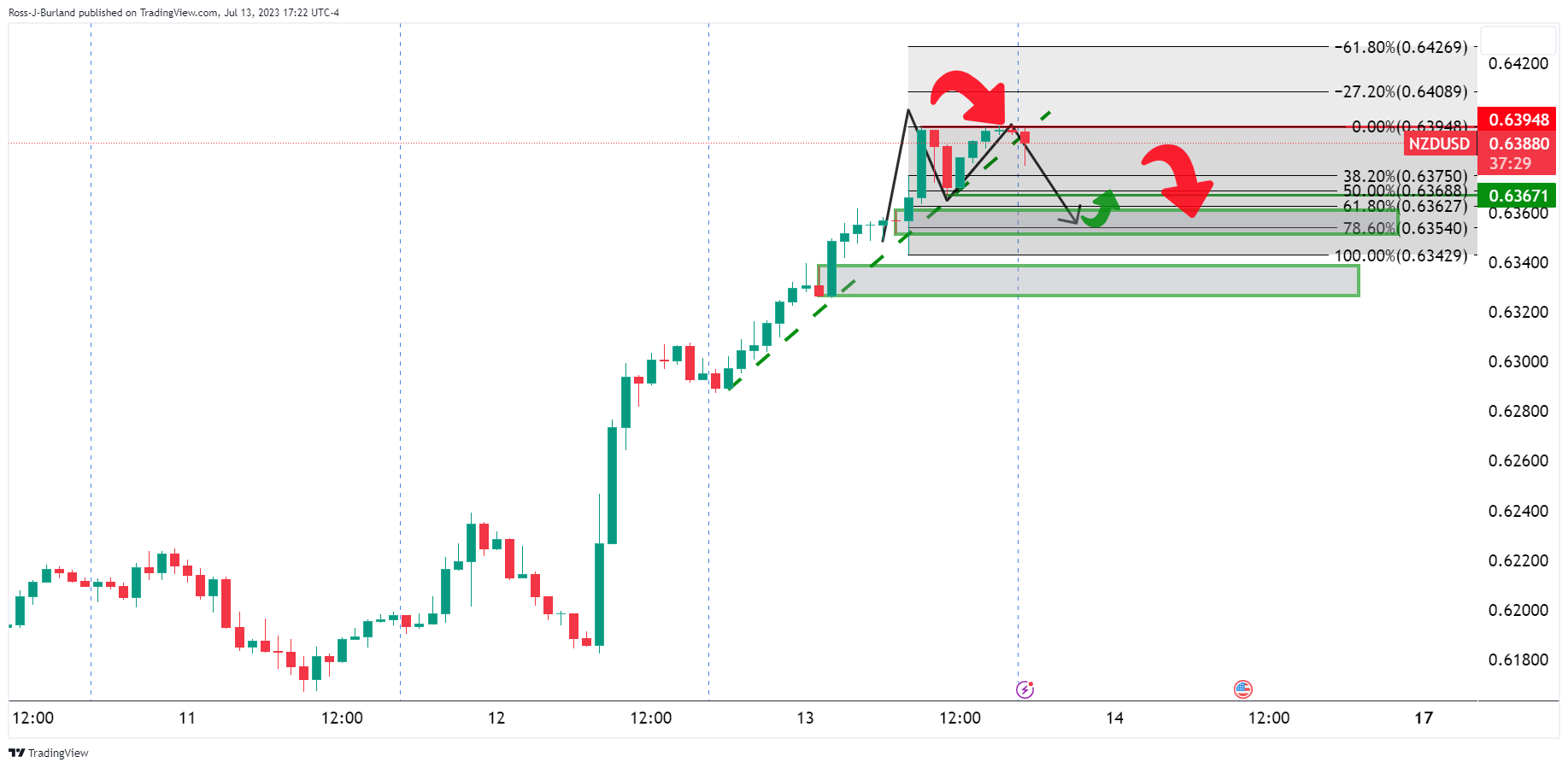

On the technical front, we have a topping pattern in play as follows:

NZD/USD H1 chart

It's the end of the week and a three-day cycle that could see the price deteriorate into longs that have been built up since Wednesday's rally. The M-formation is a topping pattern that could offer an opportunity before the week is out as traders take profits into the weekend.

NZD/USD M15 charts

We are seeing signs of deceleration, but there will need to be a break of the 0.6370s to confirm that bearish bias. even still, there are prospects of a move higher to test 0.6400/20:

NZD/USD daily chart

The daily chart is offering prospects of a continuation...traders can look for a fade if the market offers the set up to end the week.